Standing strong amidst a global pandemic.

Navigating a new normal

- Recently, 500 Startups conducted a survey with 199 female founders about the impact of the coronavirus pandemic so far.

- The survey is part of 500 Female Forces, an ongoing initiative that aims to provide and support female founders around the world.

- In the survey, 56% of female founders said they are still fundraising and two-thirds believe they will be disproportionately affected by the Covid-19 crisis, which may result in less funding.

- The biggest challenges listed by the respondents during this time were customer acquisition, increasing runway, and maintaining a healthy work-life balance. A third of respondents found difficulties in running a company while taking care of their family members.

- The survey concludes with a concrete takeaway,

“Covid-19 is not only a test of our short-term support for female founders, but also of our ability to continue creating more equitable opportunities in the long-term.”

- Download the full survey results here.

Ramadhan giving

- Spending the fasting month at home may not be an issue for some. But for families whose livelihoods are adversely affected by the pandemic, it could be a tremendous struggle.

- Under its “Kasih Ramadhan” campaign, 500-backed Fave is encouraging Malaysians to purchase Ramadan set meals from three designated restaurants to help feed a family of five to 10.

- The meals will then be distributed to appointed NGOs, where they will be given out to low-income families.

- Visit Fave’s Kasih Ramadhan page today to purchase a Fave set meal at either RM60 or RM110. More details here.

Tapping into a trillion-dollar industry

- Islamic finance is expected to become a $3.8 trillion industry by 2022.

- 500-backed Curlec has linked up with Sedania As Salam Capital to launch As-Sidq Al-Thiqa, an online marketplace for Islamic personal finance products that facilitates the customer’s Islamic financial needs, through a personalized profile assessment.

- Curlec’s direct debit platform is used to better manage the repayment process, allowing businesses to be in control of when payments are made.

- Know more about the partnership between the two fintech companies here.

- Just last month, Curlec co-founder Zac Liew was listed in Forbes Asia’s 30 Under 30 List.

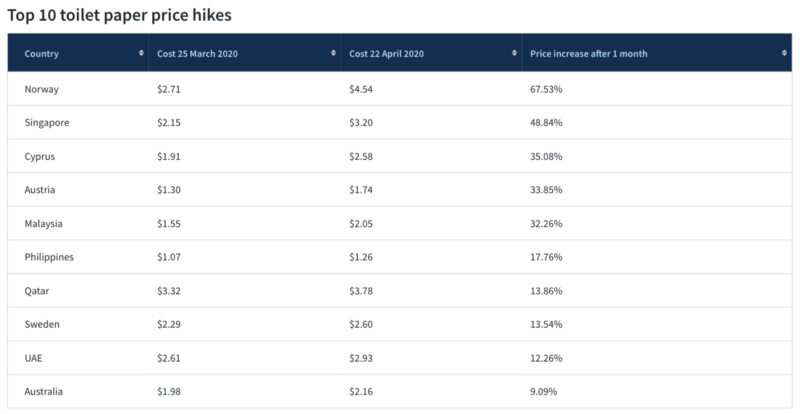

The toilet paper hype

- A hot commodity amidst the Covid-19 outbreak, prices of toilet paper have surged over a four-week period in March and April across Southeast Asia.

- Data from financial comparison platform Finder.com found that the price of a pack of four rolls of toilet paper in Singapore has increased by 48.84%.

- Other Southeast Asian countries included in the top 10 are Malaysia (32.26%) and the Philippines (17.76%).

- However, Finder.com also clarified that they “don’t know definitively whether price increases are due to retailers charging more for in-demand products, or whether people are simply reporting higher prices.”

- Check out the full report here.

- Kind reminder: Buy but don’t hoard, alright?

Stay tuned to tomorrow’s Daily Markup!

Missed out on the last Durian Daily? Go here for a full recap.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. A 500 Startups fund may have a financial interest in one or more of the companies discussed.