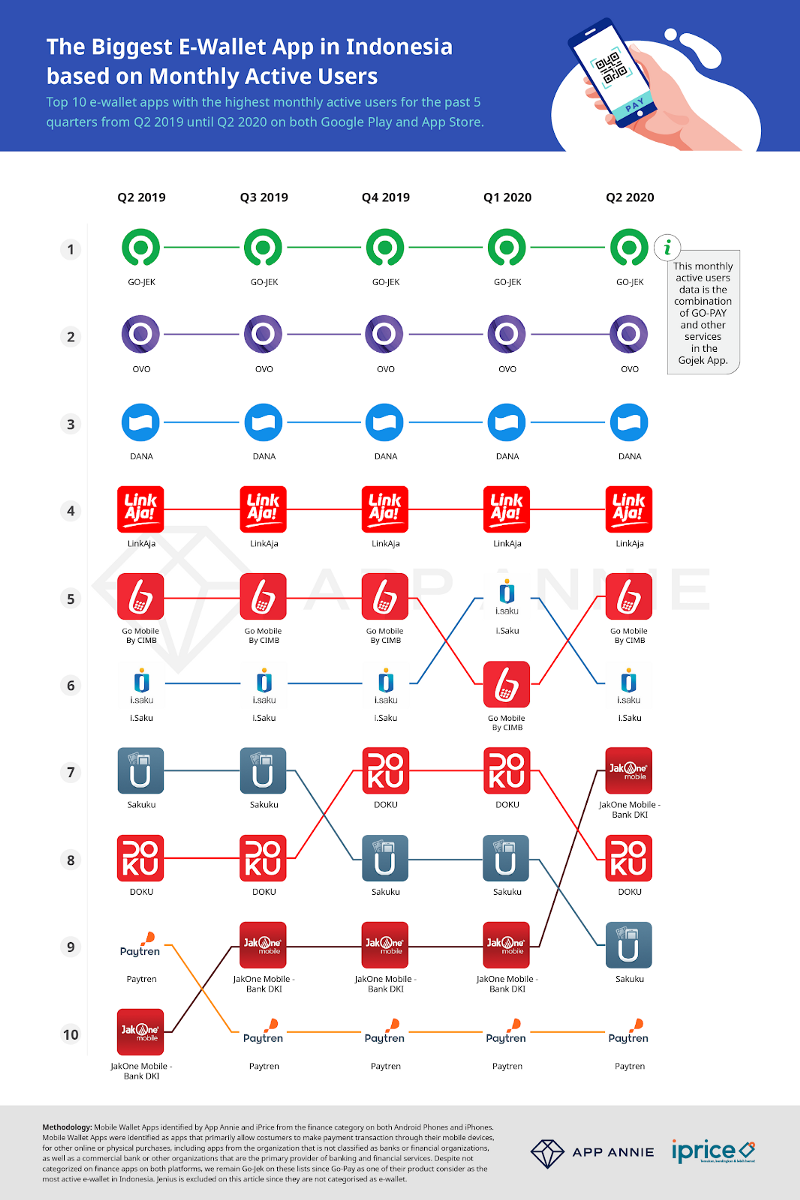

Who is the winner?

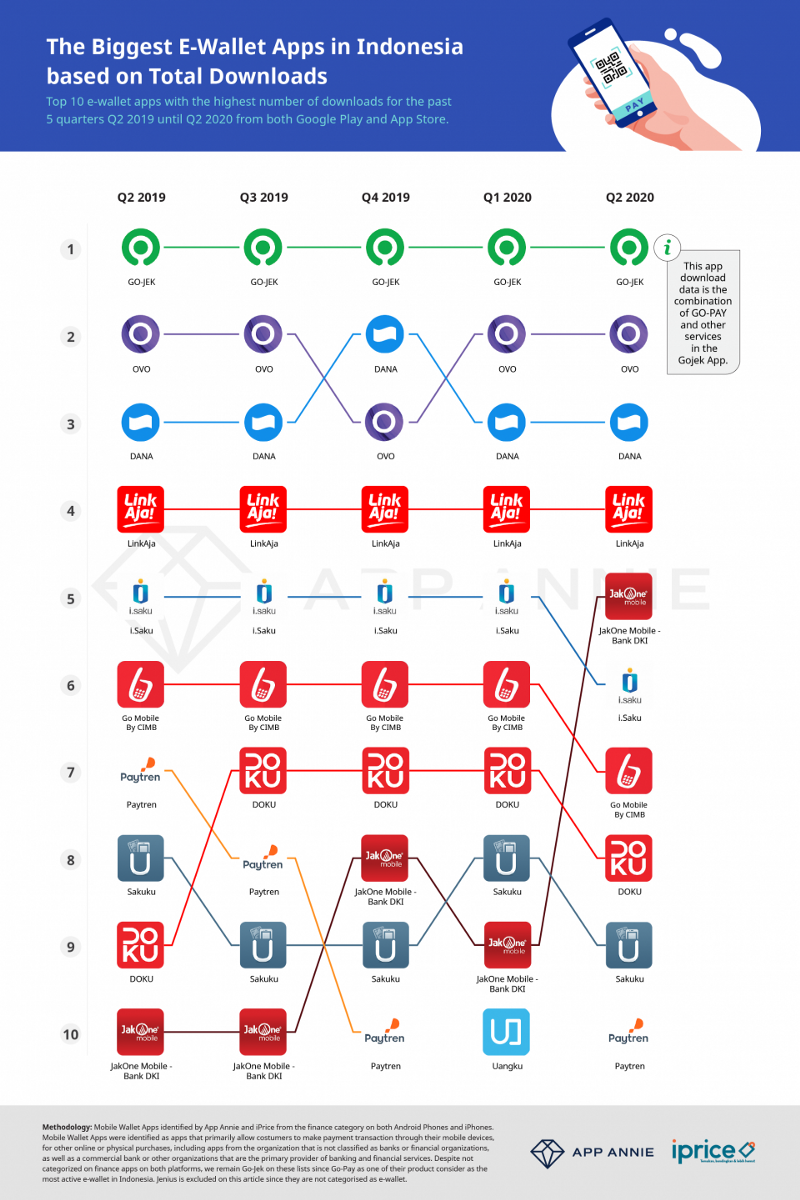

- 500-backed e-commerce aggregator and insights company iPrice, collaborated with App Annie, an app market data firm, to summarise updates on e-wallet app platforms in Indonesia from Q2 2019 until Q2 2020.

- Gojek’s GOPAY, OVO, Dana, and LinkAja are the top four e-wallets in the country, garnering the highest number of monthly active users during the period.

- According to iPrice, local Indonesian online wallet providers have maintained their dominance by regularly offering special promotions and campaigns. They’ve also received support from the nation’s government which aims to make Indonesia a cashless society.

- GOPAY, OVO, Dana, and LinkAja are also downloaded the most during the same period.

- You can read the full report here.

To infinity and beyond

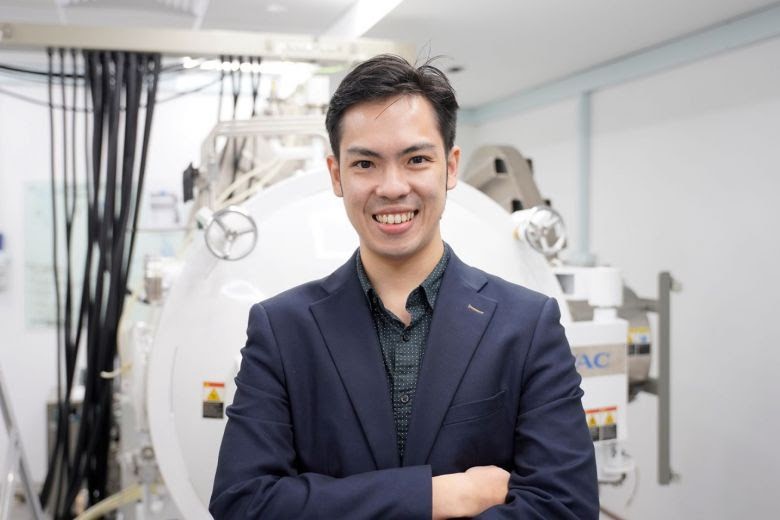

- Right after acquiring his PhD degree specializing in plasma physics, Mark Lim founded 500-backed Aliena, a space tech firm focusing on cost-effective technologies that enable satellites to maneuver smoothly in space.

- These technologies provide plasma-thruster systems, which give satellites longer lifetimes, compared to conventional thrusters that are prone to failure after extended periods of operation.

- In an interview with The Straits Times, Dr Mark underlined his motivation for high learning, which ultimately led to the founding of Aliena.

- Dr Mark, whose research papers are published at leading scientific journals like Materials Horizons and Physics of Plasma, enrolled in a part-time master’s program in plasma physics at Singapore’s Nanyang Technological University while teaching physics at a high school.

- Shortly after, he was offered a PhD program at the National Institute of Education for his contributions to plasma physics research.

- “I was also extremely fortunate to have been supported by a scholarship that allowed me to pursue my PhD full time. The support from the scholarship allowed me to further hone my craft and diversify my research through exploration into various verticals in tandem, allowing for me to publish widely and in various domains,” he said.

- It was during the pursuit of his doctorate that he founded Aliena together with his co-founders, citing his staunch belief in the application of plasma physics.

- “As a hardcore evangelist of plasma engineering in industrial applications, I recall telling my colleagues, now my co-founders, that there was so much more we could do with plasma sources — including in fields such as biomedical sciences, materials processing and even space propulsion,” he said.

- Apart from running Aliena, Dr Mark is also a principal investigator at ERI@N, the energy research body at NTU.

- Stay up to date with Dr Mark and the Aliena team here.

Things are turning around

- It’s a known fact that the pandemic has made it immensely unpredictable for startups to flourish. However, the crisis has also paved the way for new trends and opportunities to arise.

- Speaking to The Straits Times, Vishal Harnal, partner at 500 Startups, cited examples of successful companies like WhatsApp and Uber, which were founded during the 2008 financial crisis.

- With the industry going through a recovery phase after the March-April period where the outbreak was at its peak, Vishal says investors are accustomed to the new normal.

- “Now, investors are getting used to the new (market) norms and there is some concentration of capital especially among firms which are seen to be (industry leaders) and those that are promising,” Vishal adds.

- To help startups overcome this season of change, 500 Startups has not only been helping them raise funds during this period, it took part in launching the #SupportStartups initiative that collates promotions from businesses into one public platform for exposure.

- You can read Vishal’s interviews with The Straits Times here and here.

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.