Monday’s digest.

Solar for more

- A little over a week after announcing its foray into VC in Malaysia through 500-backed agro-tech startup Braintree Technologies, Petronas Ventures, the corporate venture capital arm of Petronas, has made its second investment here in renewable energy and fellow 500-backed startup SOLS Energy.

- The company, which has a first-of-its-kind academy training disenfranchised youth in solar installations, is also a graduate of last year’s Petronas FutureTech accelerator program.

- “Our mission is to connect people and businesses to real sustainable energy solutions. We believe solar PV system adoption is at an inflection point in Malaysia,” founder and CEO Raj Ridvan says of the investment while noting the solar energy industry in Malaysia and Southeast Asia is still very much untapped.

- A sister outfit of UNESC0-winning non-profit SOLS 24/7, SOLS Energy hit a milestone supplying over 1-megawatt of solar panels in Malaysia, which in turn has also saved over 1.3 million pounds of CO2 and contributed to the planting of more than 16,000 tree seedlings.

To infinity and beyond

- Transcelestial, the 500-backed and Singapore-based space-tech firm, has announced it has raised US$9.6 million in a Series A round.

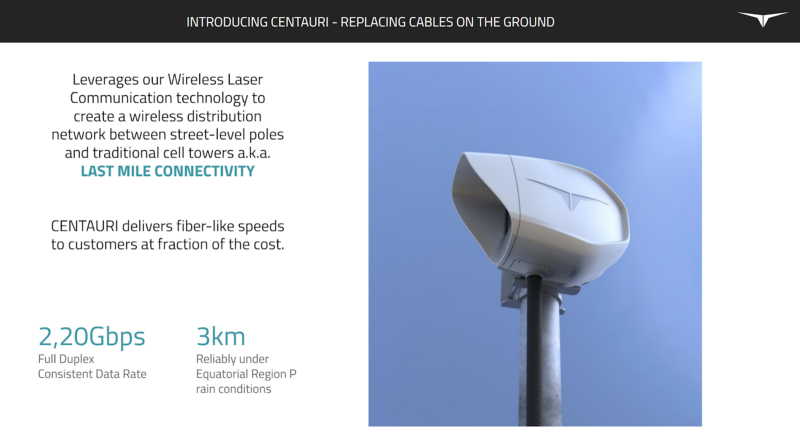

- With fresh funding to deploy, Transcelestial will focus on scaling CENTAURI, a mass-produced device that leverages the company’s wireless laser technology to create an integrated distribution network between buildings, traditional cell towers, street-level poles and other physical infrastructure.

- So far, Transcelestial has expanded to five countries and is working with leading telecommunication companies to implement its technologies.

- “With the Series A capital raise, we are now working actively to get Centauri in the hands of customers globally within the next 12 months,” says Dr. Mohammad Danesh, CTO and co-founder.

Malaysia, represent

- 500-backed marketplace for on-demand gigs GoGet will be flying the Malaysian flag high as it competes for the grand prize of US$50,000 against startups from around the globe at the final AIM 2020 Global Startups Champions League later this year.

- Prior to this, GoGet emerged first in the selection round against 10 other startups for a chance to represent Malaysia’s startup ecosystem.

- The competition is part of a series of global roadshows under the AIM event, a global stage that takes place across more than 100 countries to discover startups that have a huge potential in expanding and penetrating global markets.

- In a separate development, GoGet has partnered with Ikano Centres, IKEA Southeast Asia’s exclusive shopping center partner for stores across the region, to make its entire portfolio of shopping centers in Malaysia available through the GoGet app.

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.