Investment opportunities for all

- Indonesia’s leading e-commerce platform, 500-backed Bukalapak, has introduced a new fintech platform that provides equal investment opportunities for everyone.

- Buka Investasi Bersama (BIB) is registered and supervised by Indonesia’s financial regulator OJK, making Bukalapak the first e-commerce platform to receive a license to sell mutual funds, according to KrAsia.

- “We hope BIB will provide more accessible investment services for everyone and it will debunk the old assumption that says investment service is only for a certain group of people,” said Teddy Oetomo, president of Bukalapak and CEO of BIB in a statement.

- Bukalapak and BIB target to have 500,000 mutual fund investors by 2021, according to the statement.

- This isn’t Bukalapak’s first investment-centric product. In 2017, it launched BukaResa in partnership with online mutual funds platform Bareksa.

- BukaResa has allowed its users, many who are based in small towns outside of Jakarta and not served by traditional banking institutions, access to low risk profile and short term investment plans.

Serving SMEs

- Wai Hong Fong told Digital News Asia he grew up “geeky and eccentric”, yet those traits didn’t restrain him from co-founding 500-backed StoreHub, an all-in-one tablet-based point-of-sale system that helps business owners manage and grow their store from a single platform.

- The company started in 2013, shortly after Wai Hong met Congyu Li who is now his co-founder and CTO, on a trip to Shanghai.

- Since then, StoreHub has expanded its cloud-based offering to include a QR loyalty cashback programme, QR table ordering system for restaurants and cafés, and an e-commerce platform.

- Like many entrepreneurs before him, Wai Hong bootstrapped the first 18 months of the business. But his grit and perseverance paid off. The latest round saw StoreHub securing US$8.9 million in funding early this year.

- StoreHub currently has presence in Malaysia, the Philippines, Thailand and China with Fong looking beyond the region. The target is to grow its number of stores 2.5x by mid 2021.

- Wai Hong has ambitious plans for the company. “I would like to own up to 30% market share in the countries we are in over the next five to ten years.”

- Read Wai Hong’s feature on Digital News Asia here.

Impacting Indonesia

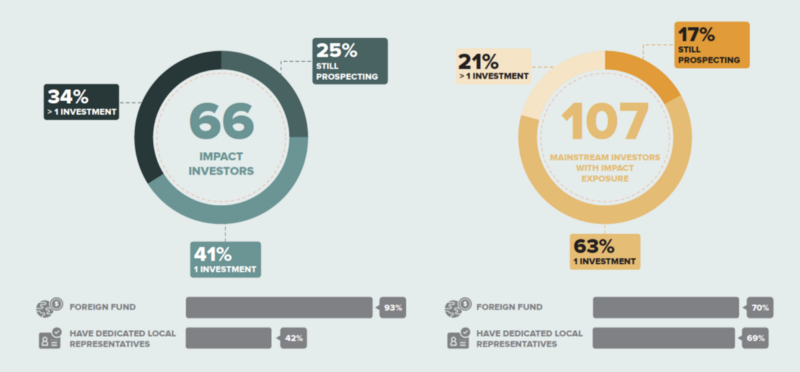

- 500-backed ANGIN, which thrives as Indonesia’s largest investment network, has released a study documenting the state of impact investing in the country.

- Since 2015, ANGIN has been observing trends in the market and noticing that more mainstream investors (VCs, corporates, and private equity firms) are also investing in social enterprises.

- In fact, this has become the “new normal”, according to ANGIN.

- “So the impact investment extended its wings to emerge as a new conception of Investing in impact where this impact becomes an arbitrage, an opportunity, a “new normal”… the smart investment to do on top of the right investment strategy,” the company wrote.

- ANGIN shares more of these insights in the detailed report, which consists of investor case studies, key trends and investment opportunities which will shape this market in the years to come.

- Download the report here.

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.