Tech growth

- 99 Group, the Singapore-based digital property media group that runs 500-backed 99.co, iProperty.com.sg, and Rumah123.com, is embarking on a tech hiring spree to accelerate innovation in the real estate industry.

- Over the next 12 months, the group is looking to hire 100 staff members to fill positions for front- and back-end engineers, app developers, product managers, UX/UI designers, and data analysts.

- In addition to boosting its tech team, 99 Group has also hired tech veteran Shivkumar Krishnan — who has previously worked at Microsoft, eBay, and Grab — as CTO.

- The Covid-19 pandemic has hastened digital transformation exercises across the property industry. It has seen a surge in listings with rich content such as videos on its platforms.

- Last month, Darius revealed to KrAsia that the pandemic didn’t adversely affect 99 Group’s business traction. In fact, there were positive developments.

Fashion expansion

- Indonesia and Malaysia will soon have its own Pomelo stores, the 500-backed fashion retailer said as part of its omnichannel expansion plans.

- Indonesia’s first store will open at Central Park mall in Jakarta this November, while Malaysia’s first store is expected to launch in the first quarter of next year.

- “Creating a seamless omnichannel experience has always been at the core of what we do at Pomelo, and it’s what allows us to continue expanding our retail presence at a time when other brands may be doing the opposite,” said Anders Heikenfeldt, chief retail officer at Pomelo.

- In Singapore, Pomelo will open its second outlet this November.

- Including its two most recent stores in The Mall Ngamwongwan and Terminal 21 in Bangkok, Pomelo plans to open three more stores in Fashion Island, Mega Bangna, and Siam Centre — all located at the city’s busy shopping districts.

- The company plans to reach 20 stores in Thailand by the end of this year.

- Pomelo started the year by acquiring fashion e-commerce platform Looksi, previously known as Zalora Thailand. With the acquisition, Pomelo added a variety of key international brands to its app and website. Some of these top brands included Adidas, Aldo, Havaianas, Topshop, Guess, Levi Jeans, and Nike.

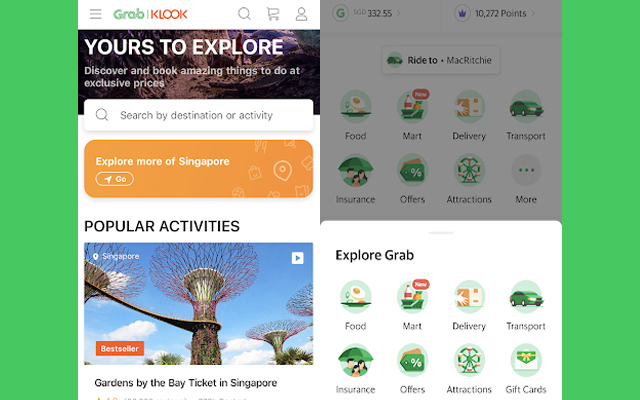

Grab and Klook!

- Grab, the 500-backed super app, will now offer booking of domestic tours and activities through integration with Hong Kong-based travel platform, Klook.

- Grab users will use a new “Attractions” tile in the app to search through Klook’s catalog of more than 100,000 domestic attractions, tours, activities, and food and beverage outlets.

- Digital tickets for the experiences are booked in the Grab app, with payment through GrabPay and loyalty points earned through GrabRewards.

- Some of the activities in Singapore include the AJ Hackett Sentosa Bungy Jump, and island hopping to visit St. John’s Island and Kusu Island. In Malaysia, users can book popular activities such as Aquaria KLCC, a sunset cruise at Langkawi or join a pottery class.

- Go here if you require more details on the Grab and Klook tie-up.

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.