Early adopter

- 500 Startups invested in Fave in 2015. The objective was to drive the online-to-offline model. But the company pivoted because of a digital gap in the retail industry.

- “The big picture was O2O. The team that founded and led Fave had the most O2O experience in the region. They began as KFit, an O2O subscription platform offering service to fitness merchants. They expanded to new categories, acquired some of Groupon’s assets and rebranded to Fave. Back then, Southeast Asia’s retail landscape was fragmented, and hardly leveraged digital or mobile. Fave was onboarding SMEs and were making so much progress at revolutionizing the retail landscape. We invested in their team and vision, and we’re impressed by their progress,” says Khailee Ng, Managing Partner at 500 Startups.

- Over the course of the next five years, Fave onboarded SMEs, helping them digitize their businesses. Now, Fave has over 35,000 SME merchants on its platform from all over Southeast Asia, providing fintech, e-commerce, and data expertise to them.

- When asked how Fave separates itself from the multitude of competitors, Khailee says the key is integration.

- “Fave serves as a fintech aggregator for the most popular cards and e-wallets helping fully digitalized payment acceptance. Merchants can focus on what they do best for their customers because Fave takes care of everything else,” Khailee says in an interview with AVCJ.

- With the recent investment from Pine Labs, India’s first unicorn, Fave is even more equipped to push its digital solutions to more merchants. Specifically, Fave’s QR code system will be housed within Pine Labs’ POS terminals.

- According to Business Standard, Pine Labs processes payments of US$30 billion per year and serves some 150,000 merchants across about 450,000 network points in Asia.

- “We are delighted that Pine Labs has invested in Fave, there’s tremendous synergy in between both companies in terms of technology transfer and market knowledge. This also bodes well for Fave’s vision of not only being a super app for merchants but also working more closely with payment partners to better serve Southeast Asia’s merchants.” Khailee adds.

Bikes on the road

- Bicycle sales are surging in the UK during the pandemic as people ditch their cars for means of affordable transportation.

- This presents opportunities for bicycle insurers like 500-backed Laka, according to the Asian Insurance Review.

- “According to our survey data, 9% of Londoners have bought a bike since the coronavirus pandemic started, compared to 4.8% of overall UK consumers,” says GlobalData insurance analyst Yasha Kuruvilla.

- For Laka, it launched a brand-new scheme enabling cyclists to cover their commute for just £1.

- Under the £1 (6-month) Laka Club membership, cyclists get third-party liability coverage for up to £2 million of legal costs if they injure someone or damage their property while using their bike, and also get covered for international trips for up to 60 days (excluding USA / Canada).

- Tobias Taupitz, CEO and co-founder at Laka notes, “Now is a time of change, and a great opportunity for cycling. Following the government’s commitment to get more people riding and a recent spike in bike sales across the UK.”

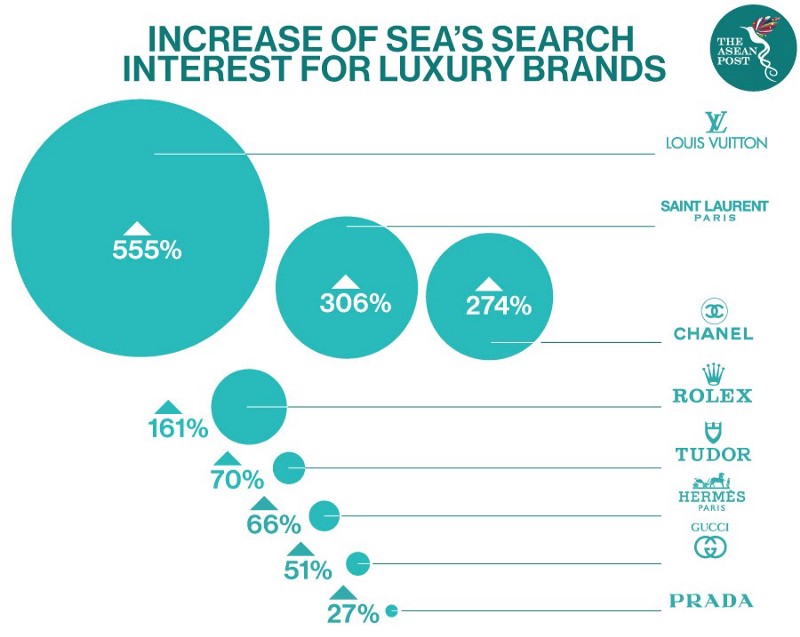

Spike in interest

- The global fashion market may be going through a difficult time, but according to iPrice data, interests for luxury goods among Southeast Asians have been skyrocketing.

- Comparing January and February impressions versus May and June’s, iPrice concludes that French luxury retail brands garnered the most interest. Louis Vuitton, Yves Saint Laurent, and Chanel topped the list.

- Southeast Asians were looking into investing in luxury watches as well. Swiss luxury watch brand, Rolex, received an increase of 160% during this period. Additionally, Tudor increased by 51%.

- “SEA consumers are still searching for luxury and fashion items despite the worldwide pandemic. It’s just a matter of where the interest is located; in this case, the interest moved from physical to online platforms,” an excerpt from the report reads.

- To read the full report and exclusive data insights on e-commerce and online consumer behavior from iPrice, click here.

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.