A stamp of approval

- In her speech at the Virtual Launch of the Singapore Fintech Association Grants and Jobs Portal, Minister in the Prime Minister’s Office and Second Minister for Finance and Education, Ms Indranee Rajah, applauded 500-backed fintech startup MyCash’s efforts in helping unbanked migrant workers.

- “This is the only remittance app in Singapore that caters to the Bangladeshi community, providing language support, inter-operability, and on-site assistance. Since launching in June, MyCash has facilitated remittance of more than $1.5 million Singapore dollars, for over 5,000 workers.” she says.

- The startup hopes to secure 30,000 users and reach S$15 million in monthly remittance volume by the end of this year.

- To date, MyCash Online has 125,000 customers spread across Malaysia, Singapore, and Australia.

- The company is currently raising a US$1 million Series A round to further grow their presence in Malaysia and Singapore.

Financing, done digitally

- Hot off the heels of its V-shaped recovery, 500-backed used-car platform Carsome has inked a partnership with one of Malaysia’s leading banks, CIMB, to provide financing and inventory management assistance to dealers on its platform.

- Dealers can expect faster processing times and minimized paperwork, as the solution is done entirely online.

- In a press release, it said the collaboration is the first of its kind in the market between a bank and a used-car trading platform.

- “Our partnership with CIMB will enable a more efficient financing option for car dealers who acquire inventory on Carsome’s platform, which in turn helps them grow their businesses,” says Carsome CEO and co-founder Eric Cheng.

- In May, Carsome launched its RM55.5 million Dealer Alliance Support Program, an initiative that provides short-term boosts in the forms of bonus rewards and credit lines to help used car dealers rebuild their businesses and finances after MCO.

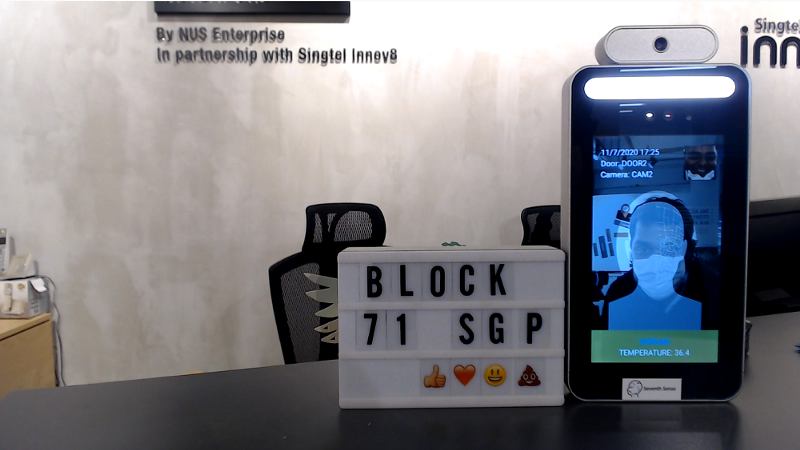

No more manual screenings

- By combining facial recognition and thermal camera processing technology, 500-backed Singapore-based AI startup Seventh Sense has helped do away manual screenings at public spaces such as shopping malls and office buildings.

- It is also working with Singapore’s largest mobile network operator to “provide live deployments for retail and workplace safety during the Covid-19 pandemic”, Varun Chatterji, co-founder of Seventh Sense, tells Vulcan Post.

- In a retail setting, it can help control and measure overcrowding, perform temperature screenings, and even provide features helping businesses to comply with safe work practices.

- Besides, the solution can also tabulate real-time data between entry and exit points for retailers to limit the number of entrants, if needed.

- Read the interview on Vulcan Post here.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.