As the Coronavirus continues to crowd headlines, this very first edition of Daily Markup cuts through the reports to show you what history (and data) has told us about venture capital and startup funding in a deep recession.

Is all hope lost? Let’s have a look.

Remember what happened in 2008?

- The global financial crisis. Economists compared it to the Great Depression of the 1930s, with some saying it was worse in many regards. Governments and industries withstood major punches, and venture capital was no exception.

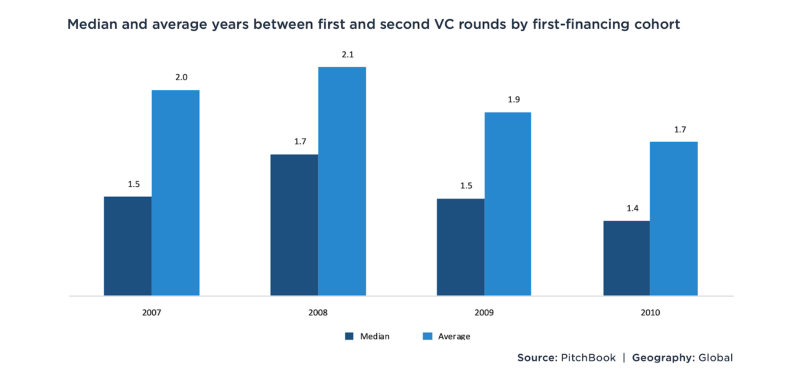

- In a 2019 study, PitchBook details how startups that received funding pre-recession experienced longer periods between financings compared to cohorts in 2010.

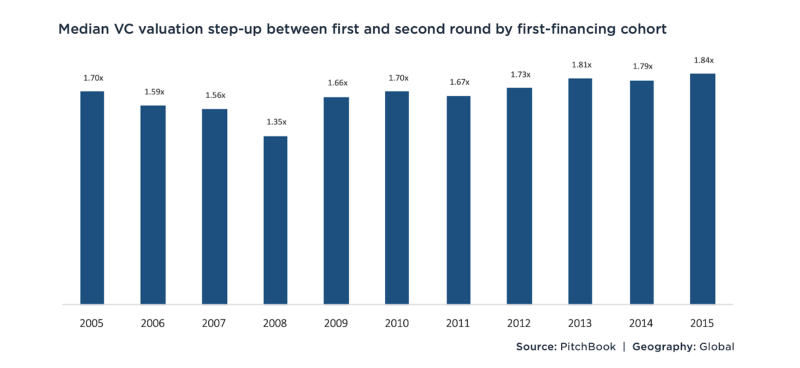

- The dip was also evident in valuation. The 2008 cohort saw a lower step-up from the post-money valuation of its first round to the pre-money valuation of its follow-on round, as compared to the 2010 cohort.

- At 500 Durians, we are preparing for the Covid-19 pandemic to usher in a potential recession. We expect a slowdown of fundraising and more modest valuations. But the restricted movement orders in some countries is something 2008 did not have to deal with.

- But modern Southeast Asian Venture Capital was born in the wake of 2008 and had raised plenty of money leading up to 2020. How will we ride it differently? We will expand more on this in the coming days.

Cash is king

- SMEs and the startups who serve them are adversely affected by the Covid-19 outbreak. As footfall decreases exponentially due to restricted movement orders across the globe, many business owners are finding themselves strapping for cash and facing the possibility of shuttering.

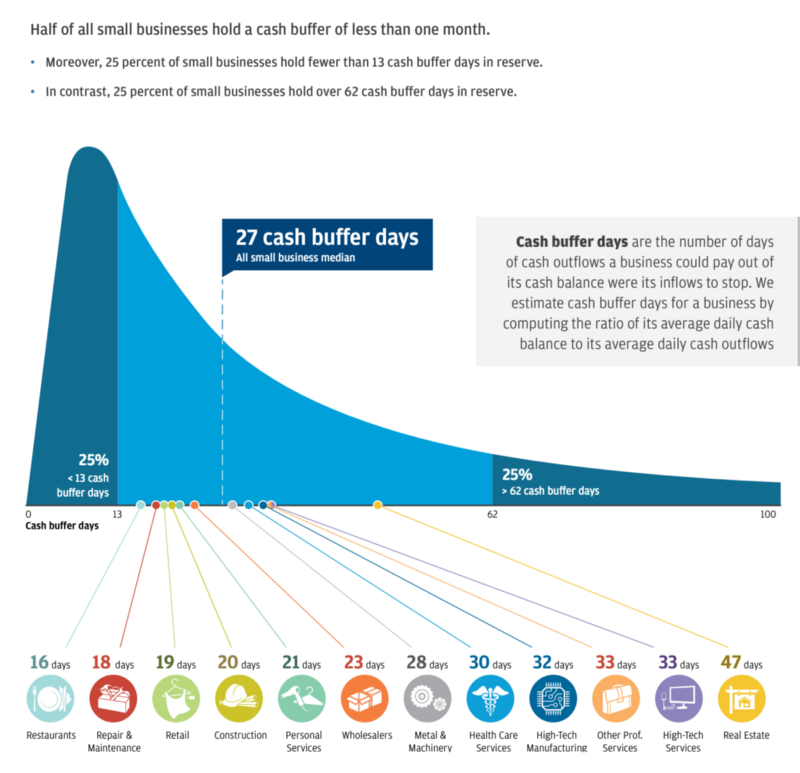

- JPMorgan Chase explains in a study titled ‘Cash Is King’ as to why cash is indeed the king, especially when times are tough.

- Dauntingly, half of all U.S. small businesses surveyed hold a cash buffer of less than a month. These include restaurants, repair and maintenance services, retail, and wholesalers. In Southeast Asia, this may not be too different, according to the study.

- Hence, governments are chipping in to help. In Malaysia, banks, government agencies, and companies like StoreHub have extended help to struggling SMEs through financial aid or dedicated features like on-demand delivery for F&B outlets.

Your startup can survive

- 500 Startups’ Eddie Thai wrote a helpful, point-by-point article on how founders can weather through the storm by taking drastic but necessary measures for survival.

- You can read Eddie’s piece here.

Bringing out the best

- Tough times bring out the best in people. We’ve never seen so much volunteerism from founders.

- Example: Malaysian e-commerce company Applecrumby & Fish is doing its part to help those in need — abroad and at home.

- Above is a photo showing a container of adult diapers the platform had sent to hospitals in Wuhan, the epicenter of the outbreak. In Malaysia, they’re giving away about 50,000 units of Applecrumby™ SanGuard Sanitizers, and 20,000 units of medical-grade masks to parents.

- They’ve also dedicated an emergency load of supplies to the Sg. Buloh pediatric ward.

- There are more examples which we will be sharing in the coming days.

Be sure to catch tomorrow’s Durian’s Daily! You can also find us on our official website, LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds.

The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. A 500 Startups fund may have a financial interest in one or more of the companies discussed.