Fintech for farmers

- Bandung-based and 500-backed aquaculture company eFishery is partnering P2P marketplace lender Investree to offer fish farmers financial assistance amidst the pandemic.

- A total of IDR 30bn will be channeled to the farmers, whose income levels have been heavily impacted by the coronavirus crisis.

- Loans will be deployed in both conventional and Shariah-compliant structures, according to reports. To ensure the creditworthiness of farmers, eFishery will provide data to Investree from its suite of IoT devices and conduct field checks at farms. Investree will then collate the information before giving out the loans accordingly.

- Fish farmers often find it difficult to secure loans from banks and financial institutions. eFishery solves this with eFisheryFund, a digital platform with financing facilities offered in collaboration with independent lenders, said CEO and co-founder Gibran Huzaifah.

- In this case, Investree acts as a partner to raise awareness for eFisheryFund.

- “We will continue to develop this collaboration so we can support up to 1,000 fish farmers by the end of 2020,” Gibran said.

- This week, eFishery announced a partnership with Baba Rafi Enterprise, which runs the world’s largest chain of kebab restaurants, to build a franchise model for shrimp farms. Using eFishery’s aqua-tech expertise, both companies will find new ways to scale local shrimp farms, starting with 200 and expanding to the thousands over the next few years.

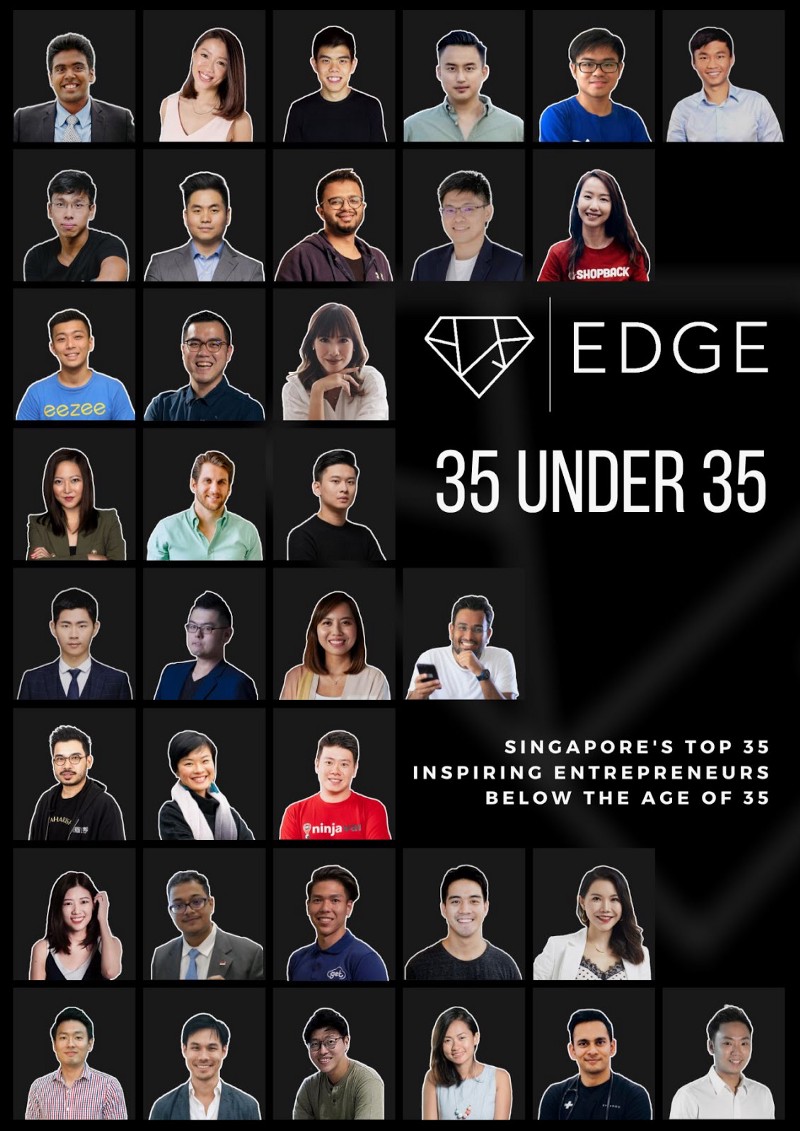

Young and inspiring

- EDGE is the youth wing of Action Community for Entrepreneurship (ACE), the national driver for the startup ecosystem in Singapore.

- In its inaugural 35 Under 35 list, EDGE celebrates “youth who have made significant contributions to the startup ecosystem in Singapore over the past year to inspire Singaporean youth to pursue entrepreneurship and adopt an entrepreneurial mindset.”

- The Class of 2020 was largely evaluated for their entrepreneurial achievements and contributions. The judging panel also looked into how the inaugural list have expanded their imprint beyond Singapore.

- Several 500-backed founders made the list. They are:

Val Yap of Parcel Perform

Cameron Priest of Tradegecko

Rohit Jha of Transcelestial

Yong Yi Sung of Grain

Walter Oh of Boxgreen

Victor Liew of Xfers

Siu Rui Quek of Carousell

Oswald Yeo of Glints - Congrats, founders!

- Check out the full list here.

Giving a ride

- As part of a trial exercise, 500-backed Neuron Mobility deployed its fleet of e-scooters in Slough, an industrial town located west of central London.

- With the UK going under a new lockdown, the company is extending a free monthly pass to frontliners serving in Slough’s National Health Service (NHS) and Emergency Services so they can get to where they’re needed most, safely and quickly. The free pass can be activated through Neuron Mobility’s app.

- “We want to show our sincere gratitude to Slough’s NHS and Emergency Services staff as they continue to travel to work every day to care for people, while many of us have the option to work from home,” said Zachary Wang, CEO of Neuron Mobility.

- Painted in striking orange, Neuron Mobility scooters are built with rider safety in mind. Some features include a 999 emergency button which tells if someone has had a fall and helps the rider call the emergency services and “Follow My Ride”, a real-time location-sharing feature that provides added security while riding alone.

- A world’s first, Neron helmets are app-controlled, meaning they can only be unlocked by the rider.

- Last month, the Singapore-based company announced it has secured US$12 million for a Series A round, bringing the total sum to US$30.5 million.

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.