Defying economic gravity

- A Deloitte report showed 100 IPOs (Initial Public Offerings) across Southeast Asia have raised ~US$6.44 billion so far.

- Thailand is leading the charge with 23 IPOs totaling ~US$3.94 billion raised, up from last year’s ~US$3 billion despite launching fewer IPOs compared to the previous year.

- Even though the IMF projected a 7.1% shrinkage of the country’s economy, “the listings of several homegrown companies in Thailand this year appealed strongly to investors and fund managers”, said Wilasinee Krishnamra, disruptive events advisory leader at Deloitte Thailand.

- 4 out of the top 10 IPOs in the region took place in Thailand, with the biggest IPO raised by the country’s largest retail departmental store operator, Central Retail Corporation (CRC). Wilasinee shared that “the offering was launched before the pandemic and raised US$1.77 billion — the largest ever in Thailand.”

- “The Stock Exchange of Thailand has also said that it wants to launch a new stock market for start-ups, as well as small- and medium-sized enterprises,” she added.

- Tay Hwee Ling, disruptive events advisory leader at Deloitte Southeast Asia and Singapore, shared that “investors can expect more Singapore-based companies to list on the stock market — a trend not seen last year but started to emerge in 2020.”

- More details about the report here.

Of safety and sustainability

- 500-backed sustainable transport operator Neuron Mobility has partnered with the Australian Road Safety Foundation (ARSF) to launch an e-scooter safety campaign.

- The partnership is the startup’s move towards “leading the way” in e-scooter safety in the country.

- ARSF will advise on Neuron’s existing e-scooter safety materials, including its safety guidelines which are used to provide e-scooter riders with lessons on how to ride safely.

- The foundation will also conduct webinars focused on best practices for accident prevention and e-scooter safety.

- Besides the sessions, ARSF will be “reviewing Neuron’s incident data annually to highlight potential improvements and also to compare e-scooters with other modes of transport.”

- “Safety is at the heart of everything we do at Neuron so we are delighted to partner with the ARSF, who are the absolute authority when it comes to road safety in Australia,” said Zachary Wang, CEO of Neuron Mobility.

- Earlier this year, Neuron launched its #ScootSafe campaign across Australia. As part of this initiative, hundreds of e-scooter riders have been briefed to “remind them of the riding rules and to highlight top safety tips and guidelines”.

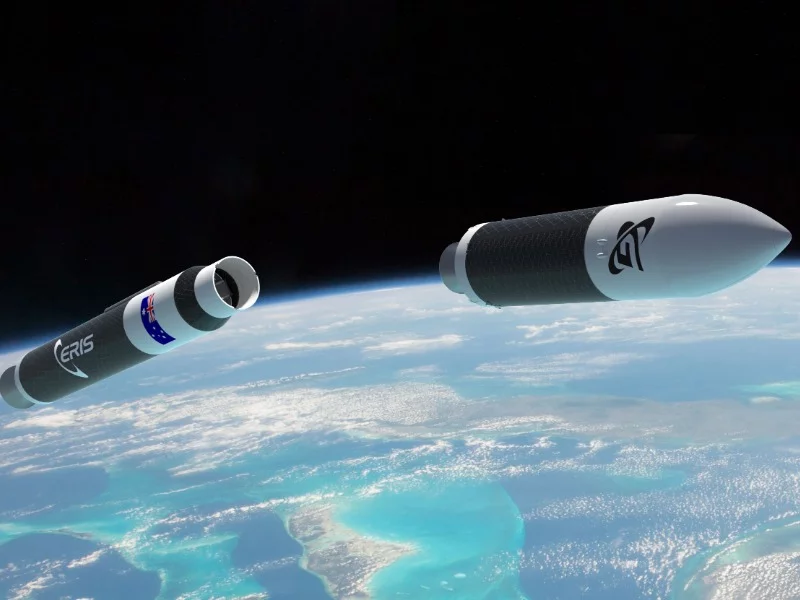

A ‘Momentus’ occasion

- 500-backed Gilmour Space has secured a partner in US-based space infrastructure company Momentus Inc., signing a multi-million dollar agreement for launch and orbital transport services.

- As part of the partnership, Momentous will purchase one “dedicated Eris launch service from an Australian launch site.” Eris is the startup’s first commercial orbital vehicle and will debut in 2022. A more capable variant, Eris Heavy, is planned for a 2025 release.

- The two companies’ complementary technologies are expected to provide Gilmour Space with the capability to “expand the flight domain of the Eris rockets” and deployment beyond low Earth orbit (LEO). Momentus will “gain access to low inclination and equatorial orbits”.

- A “significant milestone” for Gilmour Space, the partnership is a “demonstration of the way that innovative space startup companies are coming together to leverage each other’s strengths, expanding and extending commercial capabilities as far as the moon.”

- The startup has fully sold capacity on two rockets that are scheduled for 2022, exemplifying the viability of a commercial space launch business in Australia.

- Both companies are using “non-traditional and ‘greener’ technologies: hybrid rockets by Gilmour Space and water plasma propulsion by Momentus”.

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.