Rescuing F&B revenues

- When lockdown measures came into effect during the Covid-19 pandemic, there was a surge in demand for food delivery. A report showed consumers in Southeast Asia found food delivery to be the most helpful service during this time period, with Thailand and Malaysia seeing a 20x and 16x spike in searches for such services respectively.

- Founders of 500-backed StoreHub responded with a new platform that was developed and launched in just 48 hours: Beep Delivery.

- In an interview, StoreHub co-founder and CEO Fong Wai Hong said Beep Delivery was set up to help the startup’s F&B partners suffering from lockdown measures as restaurants were no longer allowed to accept dine-in customers.

- Its purpose? To take orders, accept payments, and find drivers for these businesses to ensure they can continue reaching out and connecting with customers.

- Beep Delivery was launched on 20 March 2020 — Malaysia’s lockdown measures came into effect on 18 March 2020.

- According to the interview, the ordering platform has since recorded almost 500,000 active users and ~US$74,000 in payments with more than 1,500 restaurants onboarded.

- Wai Hong believes its key offerings set it apart from other existing food delivery services, giving them a competitive edge. He shared their service is not geographically restricted, so customers can order from restaurants without any radius limit, and vice versa.

- “Beep Delivery also takes a lower percentage cut from stores for our deliveries, as opposed to the current industry standard of 30% to 35%,” he added.

- With lockdown measures easing, what’s in store for Beep Delivery’s future? The startup plans to build its own technology the platform can run on, to have full visibility and end-to-end control. Chief Technology Officer Li Congyu said, “We want to continue working with delivery partners but believe we can optimise the technology.”

Shoe-ting for the stars

- 500-backed Indonesia-based shoe brand Brodo has closed an undisclosed amount in a Series A investment.

- Brodo was established in 2010 after founder and CEO Yukka Harlanda saw a gap in the market for men’s shoes — despite Indonesia being home to quality materials and skilled shoemakers, there was no local shoe brand that could compete with international names offering stylish, affordable, and high quality products.

- This epiphany led to Indonesia’s first direct-to-consumer (D2C) shoe startup, offering both formal and casual men’s shoes.

- Initially only available online, the startup has since set up brick-and-mortar shops in Jakarta, Bandung, Bekasi, Surabaya, and Yogyakarta.

- Yukka said, “With this funding, we will double down on our product innovation and strengthen our supply chain network to help deeper penetrate Indonesia’s market. We are also preparing for our second stage of growth in order to fulfil a specific mission of making Indonesian brands cool again. This will ignite the revolution of digital-first microbrands.”

- Brodo also developed Boleh Dicoba Digital (BDD), a digital marketing platform that helps Indonesian micro, small and medium enterprises (MSMEs) bring their businesses online.

- Congratulations to the Brodo team!

Lining up for success

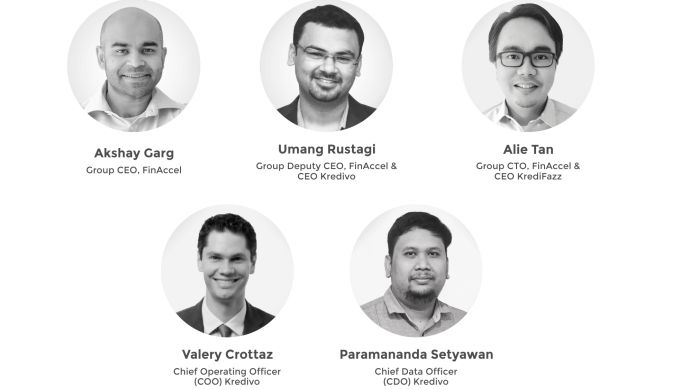

- 500-backed fintech platform Kredivo will see a management reshuffle effective 2021 as parent company FinAccel streamlines the group structure to “better serve its vision of serving 10 million customers by 2025”.

- In the new structure, current CEO of Kredivo, Akshay Garg, will be moved into the role of Group CEO, while his deputy, Umang Rustagi, will be promoted to CEO of Kredivo.

- In addition to Kredivo, Akshay will be overseeing KrediFazz, the company’s P2P platform. Both platforms will have different focus areas.

- As part of this realignment, KrediFazz will target to “expand its coverage of productive loans from 35 percent to a target of 50 percent over the next two years, focusing on serving the under-served and marginalized segments of society.”

- Garg, Rustagi, Tan, Crottaz and Setyawan said in a joint statement, “We are on a once-in-a-lifetime journey to expand access to financial services to under-banked and under-served segments of Indonesian society. With these changes, both Kredivo and KrediFazz are better placed to scale, while allowing the FinAccel group to push into new areas of innovation.”

- Last month, Kredivo, which operates FinAccel’s flagship “buy now, pay later” solution, secured a debt facility of up to US$100 million, marking the largest debt facility in the startup’s history, and “probably the largest such facility in [the Indonesian] region”.

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.