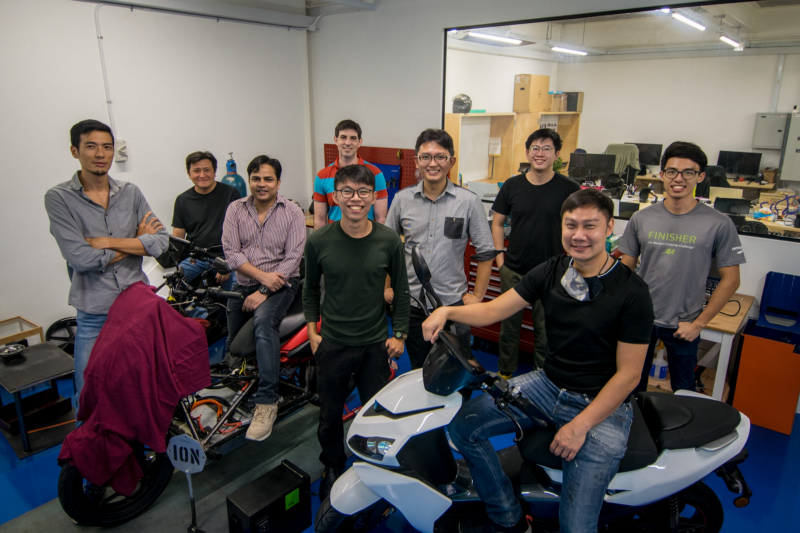

Riding the sustainable wave

- Electric motorbike startup Ion Mobility has raised US$3.3 million in a seed funding round participated by 500 Durians, 500 Startups’ Southeast Asia-focused fund.

- Ion Mobility was founded in 2019 by James Chan and Joel Chang with the aim of offering urban riders across the region affordable and sustainable alternatives to petrol-based motorbikes.

- The startup’s bikes “combine advanced software and hardware technology that will allow them to be more energy-efficient”.

- According to the announcement, the Singapore-based startup will use the funds to launch its e-motorbikes in Southeast Asia, for market expansion, and to strengthen its research and development, supply chain, and manufacturing capabilities.

- Ion Mobility plans to launch its first electric motorbike in 2021 in Indonesia, one of the biggest motorbike markets globally.

- In 2019, ~6.5 million motorcycles were distributed in the country, according to data provider Statista. A market report estimated that Indonesia’s market for two-wheelers will surpass US$10 billion by 2025.

- The startup also plans to expand its team and operations across Singapore, Jakarta, and Shenzhen, develop its in-house research and development capabilities, and build up its supply chain and manufacturing partnerships.

- “We are committed to offering riders across South-east Asia superior alternatives to their petrol-based motorbikes with our next-generation, smart and connected electric motorbikes that are clean, aspirational and affordable,” James said.

- Congratulations to the Ion Mobility team!

One app to rule them all

- Appboxo, an app integration startup based in Singapore, announced it’s secured US$1.1 million in seed funding.

- Their mission? To help any app become a “super app” by developing mini-apps that can integrate with the host app.

- This allows users to access multiple services through one app, saving them data and storage space. For example, existing mobile wallets can integrate food delivery services into their apps, and e-hailing apps can add on financial services onto their platforms, potentially opening up more revenue streams for the host app.

- The startup aims to make mini-apps more accessible to any developer who may not have the resources of a larger company.

- How? By simplifying the process of integration and guiding companies through business and partnership deals.

- The startup currently works with about 10 host apps, including Booking.com, Klook and Zalora, and has about 80 mini-apps on its platform. It has also partnered with banks, telcos, and mobile wallets.

- Co-founder and CEO Kaniyet Rayev shared with TechCrunch that the original plan was to develop an all-in-one travel app. “But when we actually started developing it, we realized there is no easy way to plug in third-party services,” he said.

- And so Appboxo was born. “Appboxo is in a unique position to revolutionise the mobile app space via its platform. Asia is currently the fastest growing mobile app market, accounting for 50 per cent of app installs by the end of 2020. Ultimately, our vision is to enable any app to become a super app and offer multiple services via our platform,” he added.

- “In the current market of super apps such as WeChat and Alipay, Appboxo offers the opportunity for any app to follow in their footsteps. This would cater to the growing consumer need for an efficient and integrated user experience,” said Vishal Harnal, General Partner at 500 Startups, who participated in the seed funding round via its Southeast Asia-focused fund, 500 Durians.

- According to a press release, the startup plans to use the seed funding to scale its platform and further develop its proprietary technology. It also plans to add new mini-apps in travel, e-commerce, finance and lifestyle industries.

- Congratulations to the Appboxo team!

The art of living

- The Covid-19 pandemic has sent countries into lockdown, confining many to their homes. Activities such as cooking, baking, and binge-watching on Netflix increased as people look for new ways to spend time at home.

- Some even begin to rethink their ideal homes in terms of location and design. “People want to seize this moment, amidst pandemic to make very real and visible changes. Many see it as a chance to transform our environment, our lifestyles and our very homes,” said Robbie Antonio, Founder and CEO of 500-backed Revolution PreCrafted.

- The startup brings together Robbie’s real estate experience and his passion for contemporary art. The result? Prefabricated homes, or simply prefabs, which are customisable, modular, and — the icing of the cake — designed by celebrities and artists, bringing world-class architecture to a wider market segment.

- The startup’s prefabs are manufactured offsite, usually in sections that can then be shipped and assembled. Hence the moniker, “the Ikea of home building”.

- This means home buyers don’t have to go through the hassle of hiring contractors, manufacturers or builders, and also save on the fees of commissioning a famous architect. The startup claims a home can be completely delivered in as quick as 60 days.

- According to Robbie, prefab homes, on average, are about 10 percent cheaper as compared to traditional homes.

- He added demand has risen in the pandemic, sharing the startup has sold 4,600 homes from their 5 residential projects in the Philippines alone. It already has 300 homes to be delivered by the first quarter of 2021.

- What’s next — or rather, where to next? The startup is set to take on North America with projects in New York, Arizona, and Los Angeles. Robbie said, “Half of our inquiries are from the US…We believe that our homes designed by critically-acclaimed visionaries and offered at a better price point have a universal appeal.”

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.