Making secondhand the first choice

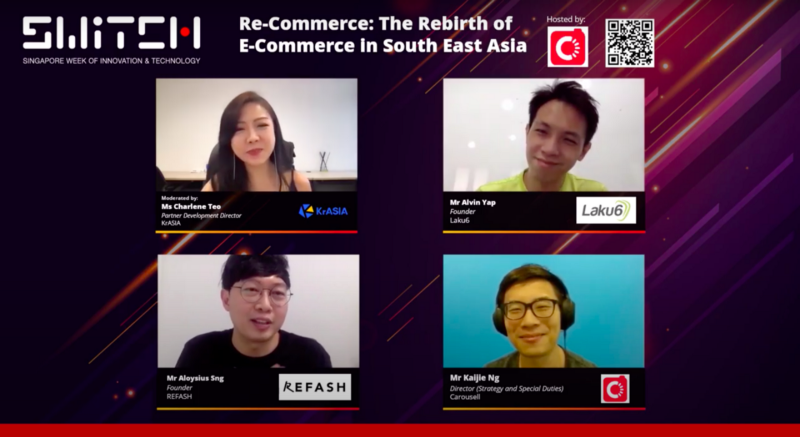

- 500-backed e-commerce startup Carousell participated in a Southeast Asia-focused panel discussion at the Singapore Week of Innovation and TeCHnology (SWITCH) titled “Re-Commerce: The Rebirth of E-Commerce”.

- The panel featured Kaijie Ng, Director of Strategy and Special Duties, who spoke about re-commerce potential in the coming years.

- On Carousell’s performance and trends in 2020, Kaijie shared from February to June, ~US$758 million transacted on the platform — that’s approximately US$3,000 per minute.

- Kaijie attributed this to users looking to make ends meet by earning extra money or getting more affordable options for necessities, adding that brick-and-mortar businesses also fueled the surge. “A lot of them were caught by surprise by the pandemic as their physical footfall dipped to zero, and they were struggling to go online,” he said.

- To help these businesses, the startup worked with the governments of Singapore, Hong Kong, and Malaysia to bring them onboard Carousell.

- He believes the stigma against secondhand items is shifting for two reasons: (1) the growing trend of sustainability — both for the environment and being a conscious consumer, and (2) a larger acceptance of the sharing economy where consumers are open to the idea of not owning something forever.

- He shared a survey in the US, showing 45% of women are open to owning secondhand items in 2016, and this number increased to 70% in 2019. “You will see this trend gradually growing over time in developing economies as well,” he added.

- Echoing the other panelists’ thoughts, he agreed items like mobile phones and laptops are no longer a luxury in the ‘new normal’. Applications like Zoom are required for kids to continue their education, and for some, the only affordable option is to go secondhand.

- Ultimately, he believes the secondhand market will solve one of the world’s accessibility and sustainability problems, but there are many barriers to entry. To tackle this, he shared that Carousell uses machine learning to make the process as simple as possible for both buyers and sellers. The app automatically provides a suggested listing price based on other similar items sold on the platform, and the review system has been improved to create trust in the ecosystem.

- “A lot more users in the market who have not bought or sold secondhand yet,” he concluded. “Our vision is to make secondhand first choice.”

- Watch the full panel discussion here.

Investing made easy

- 500-backed digital investment platform Bibit has raised US$30 million of funding to expand its products and services further. This comes after its Series A round in May 2019, bringing the startup’s total funding so far to $45 million.

- Bibit was launched in 2019 by Stockbit, a stock market social community platform for investors and traders.

- On the Bibit app, users can build their investment portfolios based on individual risk profiles and investment goals.

- The app features Robo-advisory services, making the process easier for first-time investors and millennial investors, which make up 90% of its total user base.

- According to a statement, Bibit holds a Mutual Funds Selling Agent license under Indonesia’s Financial Services Authority (OJK).

- CEO of Bibit, Sigit Kouwagam said the company saw significant growth since its launch, registering over 1 million first-time investors in just the past year. He attributed the growth to an increased awareness of and education on investing.

- The company cites data from the Indonesian Stock Exchange, and Indonesia Central Securities Depository that showed the number of retail investors in the country grew 56% year-over-year in 2020, with about 92% of new investors aged between 21 to 40.

- Congratulations to the Bibit team!

A flying start in 2021

- 500-backed Aerodyne Group has inked a partnership agreement with Germany-based QUANTO AG and Taku International LLC through its European HQ, Aerodyne Europe UAV Ltd.

- The aim is to bring Aerodyne’s drone solutions and services to Austria, Switzerland, and Germany.

- Headquartered in Malaysia, Aerodyne is a drone-based solutions provider driven by artificial intelligence technology.

- QUANTO AG is an IT and management consultancy in the DACH (Germany, Austria, and Switzerland) region. Its expertise is in large-scale project management, SAP® solutions, cybersecurity, IoT (internet of things) and AI (artificial intelligence) solutions.

- Taku International is a technology strategy and implementation company, bringing to the partnership its expertise in IoT, AI, and aviation-based sensor technologies.

- The two companies will offer Aerodyne’s drone solutions and innovative data analytics technologies to businesses across industries.

- Aerodyne Group COO Rossi Jaafar, said, “I am elated by this partnership with QUANTO AG and Taku International, which reflects Aerodyne’s deep-rooted spirit in harnessing mutual synergies with reputable tech solution providers within our geographic markets. This strategic collaboration will benefit our German, Swiss, and Austrian markets with an optimum value proposition for drone services with cutting-edge intelligence and analytics that are second to none.”

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.