Hello, Split!

Welcoming Split!

- With presence across Malaysia and Singapore, Split has raised an undisclosed seed funding led by 500 Startups. The startup was co-founded in 2018, as part of Entrepreneur First’s talent investment program.

- Split allows installment flexibility without the need for a credit card. With only a debit card, consumers can make purchases with up to three interest-free repayments.

- The technology works on major e-commerce platforms, in-store and even for businesses that sell via chat apps or social media.

- The 500-backed startup powers instalment payments for a wide variety of brands across Malaysia & Singapore in the fashion, electronics, furniture, jewelry, personal care, fitness, gifts, F&B and travel sectors.

The world of abillionveg

- With a catchy-name, Vikas Garg started 500-backed abillionveg to be the go-to, community-driven review platform that helps people across the world find and share insights on plant-based menu items, packaged foods and cruelty-free consumer products.

- Having left a lucrative hedge fund career, Vikas met Jonathan, a chef and coder at a three-month coding bootcamp. Abillionveg was conceived at Vikas’ dining table in 2017 and launched in 2018, he tells Better.sg in an interview.

- Between 2018 and 2019, abillionveg recorded over 50,000 reviews across 30,000 vegan dishes and more than 8,000 consumer products in 90 countries

- Today, abillionveg has more than 150,000 members across 122 countries.

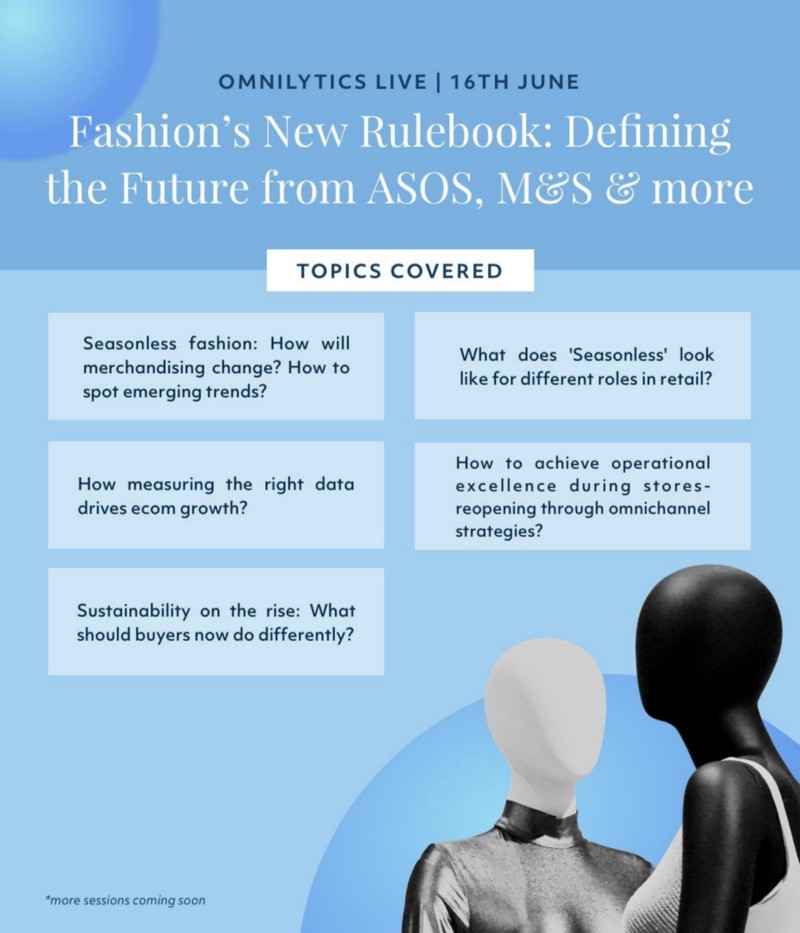

Fashion summit goes online

- Omnilytics, the 500-backed fashion analytics platform, is running a virtual summit this June 16. Glancing through the itinerary, it’s set to be an insightful event with predictions and discussions on the state of fashion, post-Covid-19.

- Called “Fashion’s New Rulebook: Defining the Future from ASOS, M&S & more”, the four-hour event will feature global retail and e-commerce leaders to discuss how the pandemic has shifted consumer buying habits and how the fashion industry can navigate through this unprecedented change.

- Headquartered in Kuala Lumpur, Omnilytics offers real-time market intelligence data to more than 70,000 brands globally. Check out exclusive reports and stay updated with them here.

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.